We are in a very odd market these days, where sellers can mostly name their prices, and homes sell within a week. It is extremely frustrating for buyers, who often have to RUSH to view a home and write an offer just to have a shot. It's hard to imagine a stronger seller's market than we're seeing almost everywhere in the US.

These strange times have prompted some folks to speculate that we'll see another 2008-style housing crash. After all, prices are going up, and what goes up must come down, right?

As the kids say these days, "cool story, bro." And here's why.

- You can't have a market crash with low inventory. Repeat. You can't have a market crash with low inventory. There's always SOMEONE who needs to buy a house, and if there aren't many homes to choose from, guess what happens? Sellers get their price. And take a look at inventory vs asking prices (CHPI).

- Current mortgage loan profiles are very healthy. Meaning, homeowners have much better credit and more equity than they did in the run-up to 2008. This makes foreclosures FAR less likely, and even when they do happen, there's equity.

- No, we aren't in a bubble. Prices have definitely gone up, but if you adjust for inflation, we're far below what we saw in 2008.

- COVID-related forbearances never became a crisis, and continue to drop. Some of the "housing crash Bros" predicted these forbearances would take us back to an '08-style situation. Nope.

- Housing-starts (new construction) are up, up, up. Builders are very bullish right now, and building permits in December 2020 were up 17% over 2019. Ask anyone in the real estate business and they will tell you we NEED more inventory!

Still not convinced?

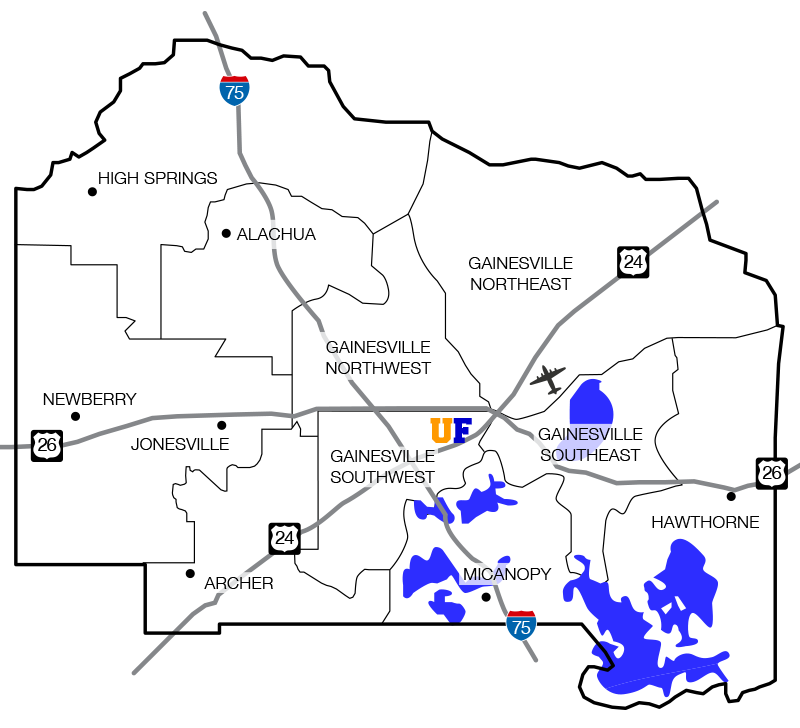

- As of today (March 29, 2021), there are 277 single-family homes for sale in Alachua County that are not already under contract.

- Over the past year, about 280 homes have sold every month in Alachua County.

- That means we are currently at about 1 month of inventory. To get to a "balanced" market -- meaning a NORMAL amount of inventory, neither a buyer's nor a seller's market, we'd need 5 more months of inventory, or 1,400 new listings. And to get to a point where there's any sort of price crash, we'd need a lot more than that -- closer to 2,200 new listings.

To summarize, we are about as close to a housing market crash as we are to getting snow in July. Yes, the market will shift and we won't be in a seller's market forever. But a "crash" like we saw in 2008? Not a chance.

Credit to @LoganMohtashami for the graphics